Net To Gross Calculator Ny

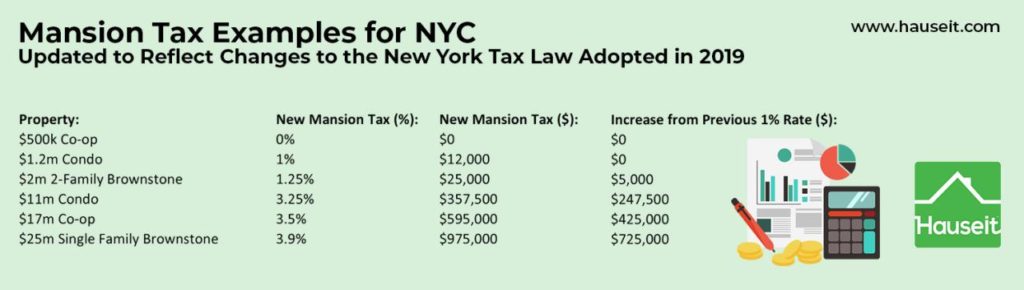

The top tax rate is the eighth highest in the country.

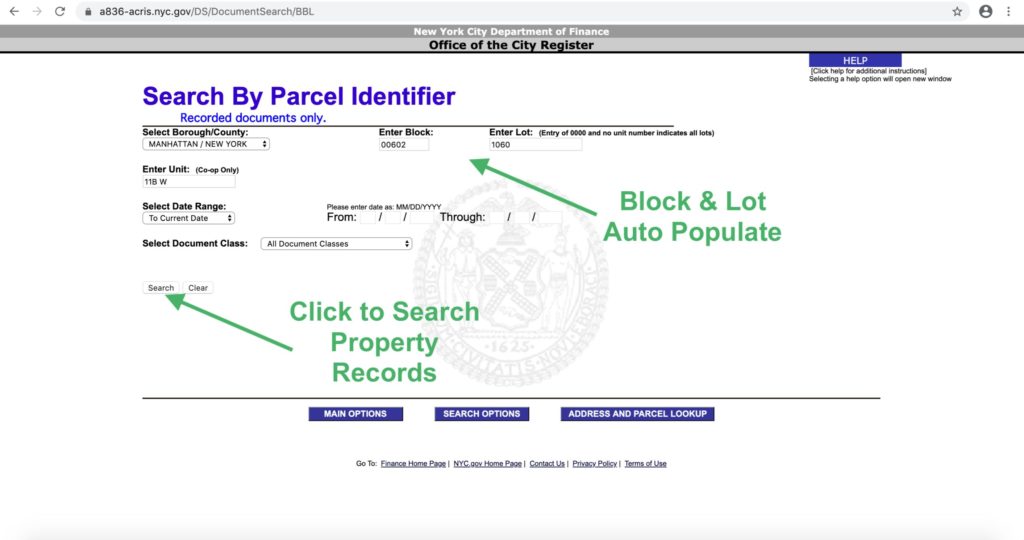

Net to gross calculator ny. Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Enter your bi weekly gross to calculate your annual salary. Use this new york gross pay calculator to gross up wages based on net pay. Social security and.

Then enter your current payroll information and deductions. First enter the net paycheck you require. Depending on the information you provide the pay rate calculator computes different information. For example if an employee receives 500 in take home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

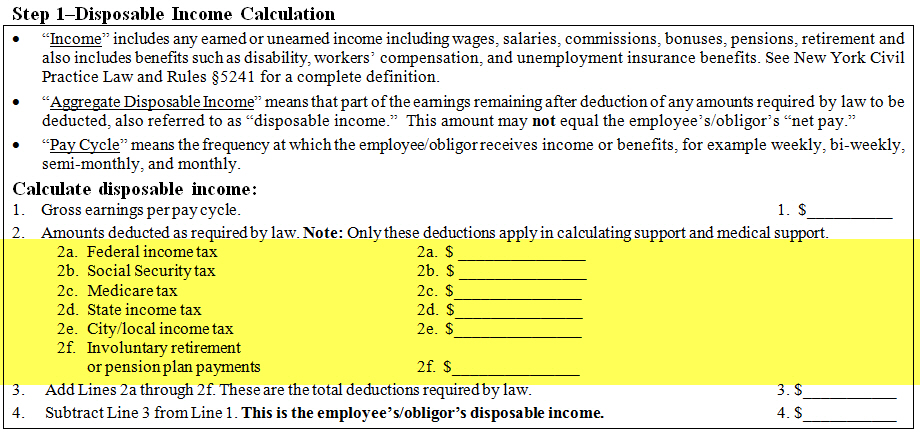

Below are your new york salary paycheck results. For heads of household the threshold is 1 616 450 and for married people filing jointly it is 2 155 350. Subtract your employee s voluntary deductions and retirement contributions from his or her gross income to determine the taxable income. New york salary tax calculator for the tax year 2019 20 you are able to use our new york state tax calculator in to calculate your total tax costs in the tax year 2019 20.

This tool has been available since 2006 and is visited by over 12 000 unique visitors daily and has been utilized for numerous purposes. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates. 401 k planner estimate the future value of retirement savings based on the interest rate contribution amount and current balance. Overview of federal taxes when your employer calculates your take home pay it will withhold money for federal income taxes and two federal programs.

We will then calculate the gross pay amount required to achieve your net paycheck. Paycheck results is your gross pay and specific deductions from your paycheck net pay is your take home pay and calculation based on is the information entered into the calculator. Calculate hourly and premium rates that could apply if you are paid overtime. Salary paycheck calculator guide how to calculate net income.

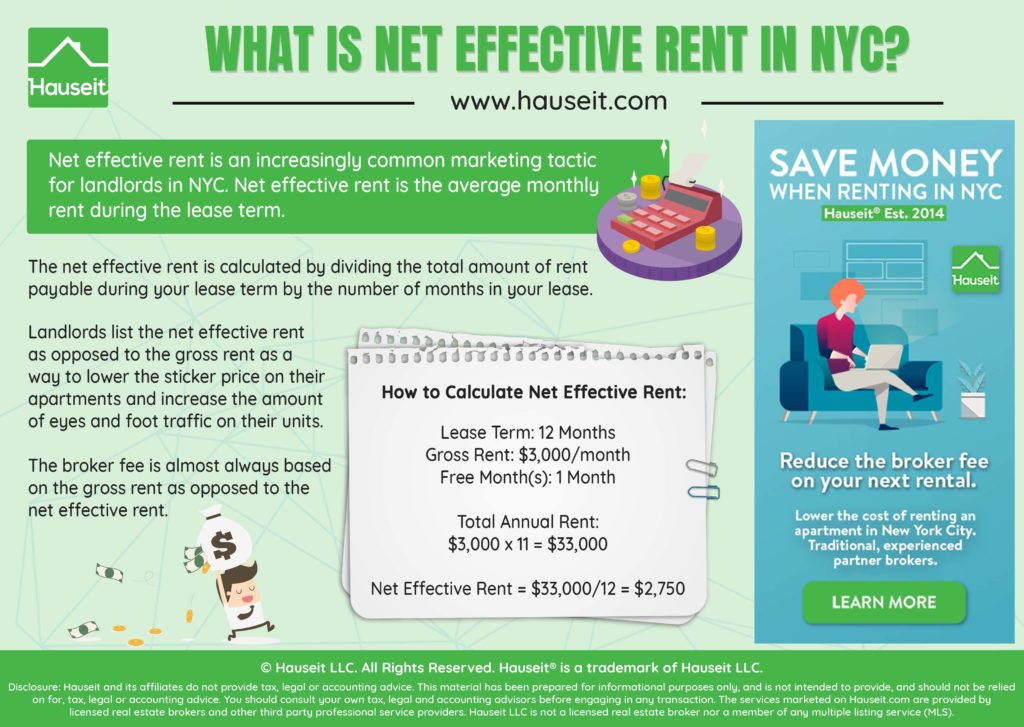

Learn more about how to calculate payroll. However only individual taxpayers whose taxable income exceeds 1 077 550 pay that rate. Our paycheck calculator is a free on line service and is available to everyone. Gross pay calculator plug in the amount of money you d like to take home each pay period and this calculator will tell you what your before tax earnings need to be.

The results are broken up into three sections. This calculator helps you determine the gross paycheck needed to provide a required net amount. Then subtract what the individual owes in taxes federal state and local from the taxable income to. Net to gross paycheck calculator.